If you’re exploring Flippa alternatives—whether you’re looking to buy high-quality online businesses or to sell your own site—this concise comparison will help you find the ideal platform. Check out the table below for key features, ideal use cases, and fee structures across the top seven competitors.

| Platform | Overview |

|---|---|

| Ecomswap |

White-glove e-com brokerage: listing, marketing & escrow. AI valuation & pre-qualified buyers. |

| Investors Club |

Zero seller fees & 24-point due diligence. Private marketplace with verified members. |

| Motion Invest |

Content-site deals under $50K. Free migration, escrow agent & no listing fees. |

| Acquire.com |

Curated marketplace with vetted buyers. AI matching, secure escrow & valuation tool. |

| FE International |

Global M&A advisory: valuation, due diligence & legal. $50 B+ in deals closed. |

| SideProjectors |

Free indie project listings. Direct deals; $3/mo premium for alerts. |

| Empire Flippers |

Rigorous vetting & diverse asset types. Expert support & weekly new listings. |

1. Ecomswap: A Flippa Alternative with premium brokerage & stellar buyer network

Ecomswap is a premium M&A platform built for mid-market e-commerce businesses, delivering a full white-glove experience. A single dedicated broker manages every detail—from crafting and promoting your listing to negotiating offers and overseeing escrow and legal formalities.

- 93 % success rate with deals closing in under two months on average

- AI-powered Valuation Calculator: get instant, data-driven business valuations and tailored recommendations

- Vetted buyers: connect only with investors who have verified funds, eliminating tire-kickers

- Turnkey financials: experts prepare industry-standard statements for effortless due diligence

- Escrow & legal safeguards: secure transactions and strict confidentiality protect your sensitive data

By pairing hands-on brokerage with cutting-edge tech, Ecomswap maximizes your sale price while keeping the process seamless.

Get the best price for your business — we take care of the rest.

Start Selling for Free2. Investors Club: A Flippa Alternative offering zero fees & elite due diligence

For those seeking a curated and trustworthy platform to buy or sell online businesses, Investors Club is an excellent Flippa alternative that offers a range of unique benefits.

One of the standout features of Investors Club is its zero seller fees. Unlike many other marketplaces that charge significant commissions, Investors Club allows sellers to keep 100% of their sale proceeds. This can be particularly advantageous for high-value businesses, where even a small percentage in fees could translate to substantial losses.

The platform also boasts a rigorous 24-point due diligence process, which is conducted at no extra cost to buyers. This comprehensive process includes seller ID verification, domain ownership checks, traffic and revenue validation, and a detailed SEO audit. These checks ensure that every website listed on the platform has verified earnings, traffic, and a clean history, significantly reducing the risk for buyers.

Investors Club provides detailed SEO analysis reports for each listing, which is essential for understanding the long-term potential of a content-based website. These reports evaluate key factors such as domain authority, backlink profile, keyword rankings, and technical SEO health. This level of transparency allows buyers to make informed, data-driven decisions and identifies any potential risks or areas for improvement.

The platform operates as a private marketplace with verified members, ensuring confidentiality and direct communication between buyers and sellers. Sellers have the flexibility to set their own asking price and are not bound by exclusivity agreements, giving them more control over the sale process.

For buyers, Investors Club offers a suite of buyer-friendly features designed to streamline the acquisition process. The platform provides early access to listings and off-market deals for premium members, along with software discounts and efficient, secure transaction processes.

Overall, Investors Club’s focus on curation, transparency, and zero seller fees makes it an attractive option for both buyers and sellers looking for a reliable and efficient marketplace to transact online businesses.

Receive an instant valuation with our Ecommerce Business Valuation Tool.

Get My Valuation3. Motion Invest: A Flippa Alternative for verified content sites at bargain prices

For those looking to buy or sell content-based websites, particularly in the lower valuation range, Motion Invest is a highly recommended Flippa alternative.

Motion Invest specializes in listings below $50,000, with a significant number of websites priced under $10,000. This focus makes it an ideal platform for buyers and sellers dealing with smaller, yet profitable, online businesses that might not be supported by larger marketplaces.

The platform is known for its rigorous verification process. Each listing is thoroughly vetted, with the Motion Invest team verifying the traffic and revenue of every website before it is published. This includes providing detailed data such as profit per month, visitors per month, domain authority, and articles posted.

Additionally, screenshots from Google Analytics and affiliate or ad display networks are provided to ensure the accuracy of the claimed traffic and earnings.

Motion Invest offers several buyer-friendly features. The platform provides free migration assistance to ensure a smooth transition of the website from the seller to the buyer. It also acts as an escrow agent, protecting both parties during the transaction.

There are no listing fees for sellers; fees are only paid if the site sells.

The listing pages on Motion Invest are highly detailed, including “Quick Stats” and a monthly breakdown of users and earnings. The platform also provides useful keyword data from SEMRush and backlink data from Ahrefs, giving buyers a comprehensive view of the website’s performance and potential.

Motion Invest uses a unique Dutch auction system, where the initial price of the website decreases over time until it is sold or reaches the reserve price. Buyers can also submit specific offers, although these are typically not reviewed for the first 48 hours after a site is listed. Another notable aspect is that the URL of the website is revealed publicly during the sale process, which, while increasing the risk of copycats, provides transparency and convenience for potential buyers.

Overall, Motion Invest’s curated marketplace, detailed listings, and buyer-friendly services make it an excellent choice for those looking to buy or sell content-based websites in the lower to mid-range valuation bracket.

Our AI recommends the best listings based on your investment profile.

Discover Miles4. Acquire.com: A Flippa Alternative featuring handpicked deals & frictionless closings

Acquire.com stands out as a robust and user-friendly platform for buying and selling profitable online businesses, making it a strong Flippa alternative.

One of the key strengths of Acquire.com is its extensive and curated marketplace. With over 1,000 vetted online businesses for sale—including SaaS, e-commerce, agencies, content sites, newsletters, mobile apps, and crypto businesses—buyers have a wide range of options to choose from. The platform’s proprietary algorithm matches sellers with qualified buyers whose preferences align with the business type and value, ensuring efficient and targeted negotiations.

The process of buying or selling on Acquire.com is streamlined into three clear steps. Sellers can create professional listings with detailed information about their business, including financials and growth potential. This format ensures the business is presented in the best light to attract serious buyers. Once a match is found, direct communication facilitates efficient negotiation. Finally, the closing process is handled securely through Escrow.com, ensuring funds are transferred only when all terms are met.

Acquire.com offers significant support for both buyers and sellers. For sellers, the platform provides expert help in creating the perfect listing, fielding offers from qualified buyers with verified funds, and closing deals safely and efficiently. Sellers can also benefit from valuation and pricing guidance, helping them set realistic pricing expectations based on market trends and comparable sales.

Buyers on Acquire.com can leverage various tools and services to streamline their acquisitions. The platform offers access to exclusive listings, M&A courses, and expert guidance on every deal. The “Buyer University” feature provides M&A masterclasses, helping buyers build wealth through acquisition. Additionally, the “Buyer Concierge” service offers personalized support during live sessions, and buyers can network with other investors in an exclusive community.

Acquire.com also emphasizes confidentiality and security. Sellers can keep their business listings private, revealing sensitive details only to verified buyers. This adds a layer of confidentiality, which is especially important for businesses that are still operating during the sale process.

Overall, Acquire.com’s comprehensive suite of features, curated marketplace, and expert support make it an excellent choice for those looking to buy or sell profitable online businesses efficiently and securely.

5. FE International: A Flippa Alternative delivering expert M&A for maximum exit value

For those seeking a professional and comprehensive approach to buying or selling online businesses, FE International stands out as a premier Flippa alternative.

FE International is an award-winning global M&A advisory firm specializing in the sale of online businesses, including SaaS, e-commerce, and content businesses. Founded in 2010, the company has completed over 1,500 transactions with a combined value exceeding $50 billion, showcasing its extensive experience and success in the industry.

The firm offers a range of services tailored to the needs of both buyers and sellers. Their investment banking services include M&A, private capital placement, and valuation services, all designed specifically for the middle market.

This expertise ensures that clients receive accurate valuations and fairness opinions, enabling them to make informed decisions about their transactions.

FE International’s due diligence services are particularly noteworthy. The company provides comprehensive due diligence to uncover relevant information about the financials and operations of a business. This includes valuation analysis, fairness opinions, financial transparency, and expert reporting—key elements for ensuring the integrity and success of a transaction.

The firm boasts an extensive network of pre-qualified international investors, which is a significant advantage for sellers looking to maximize their sale price. With headquarters in New York and regional offices in Miami, San Francisco, and London, FE International has a global reach that connects clients with a diverse pool of potential buyers.

FE International’s approach is highly personalized and strategic. They assist clients at every step of the process, from exit planning to closing the deal. The company’s team includes experts in various fields such as valuation, accounting, and legal matters, ensuring that all aspects of the transaction are handled professionally and efficiently.

For buyers, FE International offers access to a curated selection of high-quality online businesses. The firm’s rigorous vetting process ensures that only legitimate and profitable businesses are listed, reducing risk for buyers and increasing the likelihood of a successful acquisition.

Overall, FE International’s expertise, global reach, and comprehensive services make it an excellent choice for those looking to buy or sell online businesses in a professional and secure environment.

6. SideProjectors: A Flippa Alternative as a cost-free marketplace for side hustles

SideProjectors is a unique and user-friendly marketplace designed for the buying and selling of side projects. It stands out as an interesting Flippa alternative for individuals looking to transact small to medium-sized online ventures.

The platform operates on a simple and cost-effective model: there are no fees for listing a project for sale, and likewise, no fees for purchasing one. This zero-fee approach makes it particularly appealing to developers, indie entrepreneurs, and small business owners who want to trade their side projects without incurring extra costs.

Often referred to as the “Craigslist” of side projects, SideProjectors connects buyers and sellers directly without handling payment processes. While this means there is no built-in escrow system, it also allows for more flexible and direct negotiations. However, it’s essential for users to perform their own due diligence to verify the legitimacy and quality of the projects being bought or sold.

Each listing on SideProjectors provides a reasonable amount of information, but since some fields are not mandatory, there may be missing details such as traffic analytics, revenue, social media following, or subscriber/member numbers. Despite this, the platform remains a clear and straightforward way to discover and showcase side projects.

The platform supports a diverse range of listing categories, including SaaS, e-commerce, blogs, websites, mobile apps, browser extensions/plugins, and even domain names. This variety makes it a versatile marketplace for different types of online projects.

For those actively seeking new opportunities, SideProjectors offers a premium membership for a small monthly fee of $3. Premium members gain access to features like notifications and enhanced search functionality, which can be particularly useful for staying updated on new listings.

In summary, SideProjectors is an excellent choice for anyone looking to buy or sell smaller, innovative side projects in a cost-effective and straightforward way.

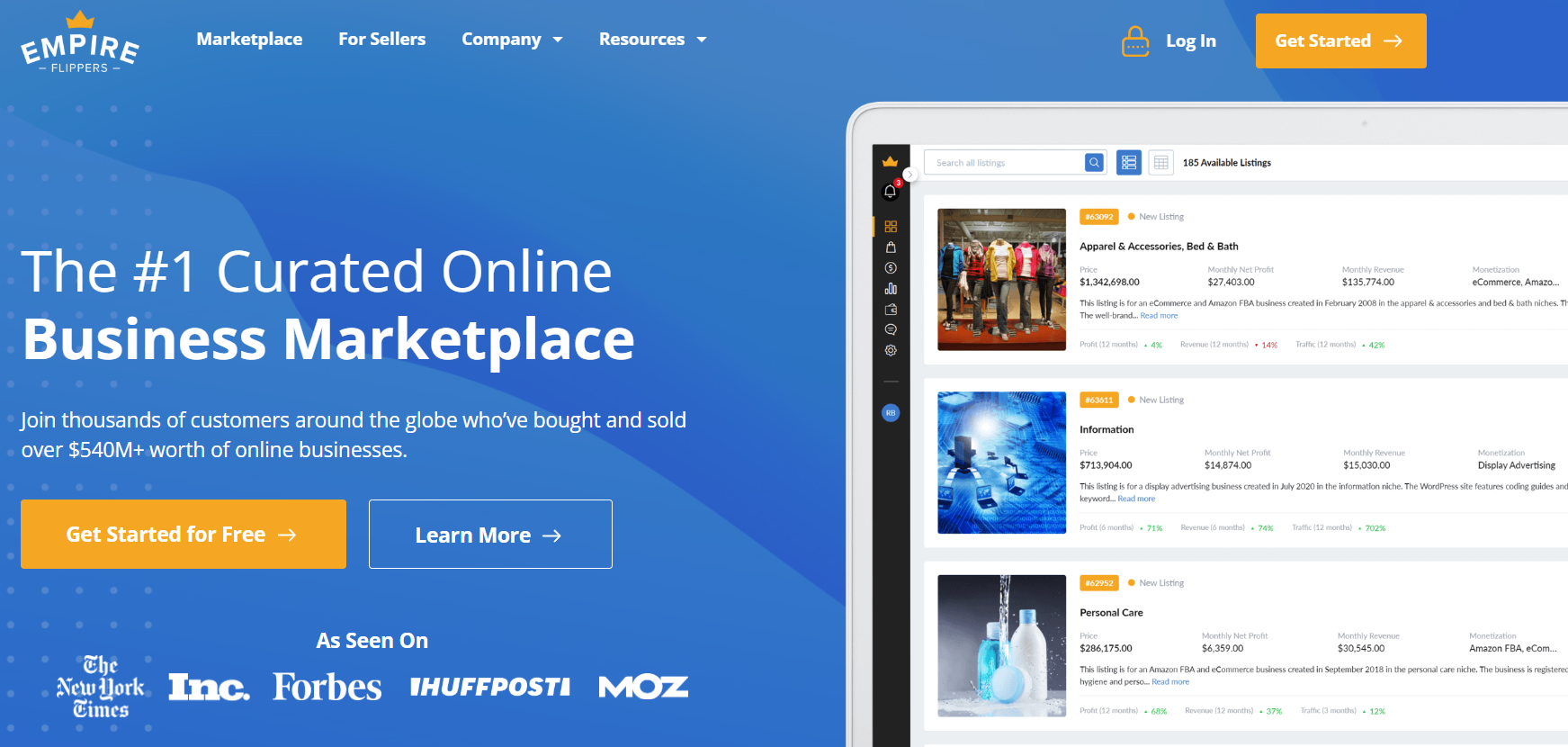

7. Empire Flippers: A Flippa Alternative known for rigorous vetting of high-quality assets

Empire Flippers is one of the most reputable and comprehensive marketplaces for buying and selling online businesses, making it a standout Flippa alternative.

One of the key strengths of Empire Flippers is its rigorous vetting process. The platform rejects the majority of businesses that apply to be listed, ensuring that only high-quality, profitable businesses make it to the marketplace. This stringent vetting includes verifying the financials, traffic, and overall health of each business, providing buyers with a high level of confidence in their potential purchases.

The platform offers a wide range of business types, including e-commerce, SaaS, affiliate marketing, and Amazon FBA businesses. This diversity allows buyers to find businesses that align with their investment goals and expertise.

For instance, Empire Flippers has a dedicated section for Amazon FBA businesses, which are already generating revenue and have an established market share, eliminating the risks associated with starting from scratch.

Empire Flippers provides extensive support throughout the buying and selling process. For buyers, the platform offers tools to streamline due diligence, such as access to detailed financial statements, Google Analytics data, and other critical metrics.

Once a buyer is interested in a business, the Empire Flippers sales team guides them through the entire process, from making an offer to finalizing the purchase and transferring the assets.

Sellers also benefit significantly from Empire Flippers’ services. The platform handles the entire sales process, from listing and marketing the business to negotiating with potential buyers and transferring the assets.

This includes weeding out non-serious buyers and ensuring that the seller receives the maximum value for their business. Empire Flippers also offers a valuation tool to help sellers determine the worth of their business before listing it.

The marketplace is updated regularly, with new businesses listed every Monday. This ensures that buyers have a constant flow of new opportunities to explore.

Additionally, registering for a free account on the platform provides access to enhanced features such as watchlists, custom filters, and notifications, making it easier for buyers to find and track their ideal business.

Empire Flippers’ reputation is further solidified by its status as an Inc. 5000 company and its track record of over $530 million in online businesses sold. This level of success and expertise makes it a trusted and reliable platform for both buyers and sellers in the online business market.

Evaluating the Best Platform for Your Needs

When deciding on the best platform for buying or selling online businesses, several key factors need to be considered to ensure you make an informed decision that aligns with your goals and needs.

Factors to Consider

Market Fragmentation and Size of the Market Opportunity

It is important to evaluate the fragmentation of the market and the size of the market opportunity. A highly fragmented market with many small suppliers or buyers is generally more favorable for a marketplace, as it reduces the resistance from large, dominant players. Additionally, conducting a thorough Total Addressable Market (TAM) analysis is essential to understand the potential scale and growth of the market. However, it’s important to consider not just the size of the market but also the percentage of the market that is likely to use the online platform.

Integration and Technology

The ability of the platform to integrate with other key technologies is vital. Ensure that the platform seamlessly integrates with tools such as payment gateways, analytics software, and other essential systems. This integration can significantly enhance the user experience and operational efficiency of the marketplace.

Trust, Liquidity, and Brand

Establishing trust, improving liquidity, and generating a positive brand are critical for the success of an online marketplace. A platform that has built trust with its users can capture more value without compromising retention rates. This trust also improves liquidity, making it easier for buyers and sellers to find each other and complete transactions. A strong brand can create a competitive barrier, making it harder for new entrants to gain traction.

Customer Base and Traffic

For buyers, evaluating the customer base and traffic patterns of the businesses listed is paramount. Understanding the demographics of the audience, customer retention rates, and the sources of traffic can help gauge the business’s potential for growth. It is also important to analyze previous marketing campaigns and strategies to factor in any associated costs and their impact on the business.

Fees and Value Capture

Consider the fee structure of the platform and how it captures value. While some platforms may charge higher fees, they may also offer more value through additional services such as due diligence, escrow, and migration assistance. Ensure that the fees align with the value provided and do not overly burden either the buyer or the seller.

Support and Services

The level of support and additional services provided by the platform can be a significant differentiator. Look for platforms that offer comprehensive support, including valuation guidance, marketing assistance, and post-sale support. These services can make the buying and selling process much smoother and more secure.

Transparency and Verification

Transparency and verification are essential for building trust in the marketplace. Opt for platforms that have a rigorous vetting process to ensure the accuracy and legitimacy of the listings. Detailed financials, traffic data, and other critical metrics should be readily available to help buyers make informed decisions.

By carefully considering these factors, you can select a platform that best meets your needs, whether you are looking to buy or sell an online business, and ensure a successful and secure transaction.

Conclusion

When navigating the complex landscape of buying and selling online businesses, it is essential to choose the right platform to meet your specific needs. The alternatives to Flippa, such as Ecomswap, Investors Club, Motion Invest, Acquire.com, FE International, SideProjectors, and Empire Flippers, each offer unique benefits and cater to different segments of the market.

Remember to evaluate factors such as the vetting process, fees, support services, and the type of businesses listed. Consider the level of transparency, the ease of use, and the additional services provided by each platform. By carefully selecting the right marketplace, you can ensure a secure, efficient, and successful transaction.

Take the next step by exploring these platforms in detail and finding the one that best aligns with your goals. Whether you are a seasoned investor or a new entrant in the online business market, the right platform can make all the difference in achieving your objectives.