Buying a Shopify store is less about finding a “hidden gem” and more about running a clean, methodical process. If you follow the steps below, you will know where to look, how to price a deal, how to verify the numbers, and how to close safely.

In essence, a 10 point checklist on how to buy a Shopify store, 2025 edition.

What is a Shopify Store?

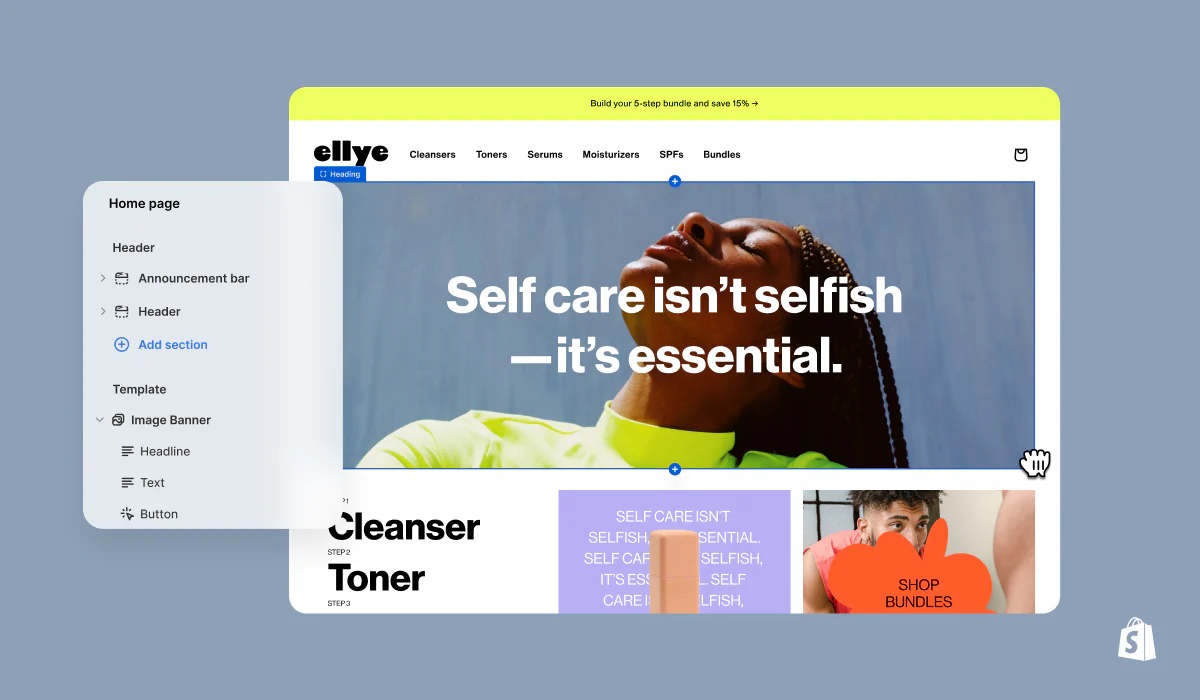

A Shopify store is an e-commerce business that runs on Shopify’s hosted platform. Shopify provides the storefront, checkout, payments, and a large app ecosystem.

The seller typically owns the domain, brand, product catalog, supplier relationships, and customer data. Ownership of the store itself is transferred to you inside Shopify’s admin by changing the store’s primary owner and handing over related assets like domains and apps.

Get the best price for your business — we take care of the rest.

Start Selling for FreeHow to Buy a Shopify Store in 2025?

Shopify shut down its own Exchange marketplace in November 2022, so you will not be buying through Shopify’s old listing site. In 2025, buyers source deals through curated marketplaces and brokers, operator communities, or private introductions.

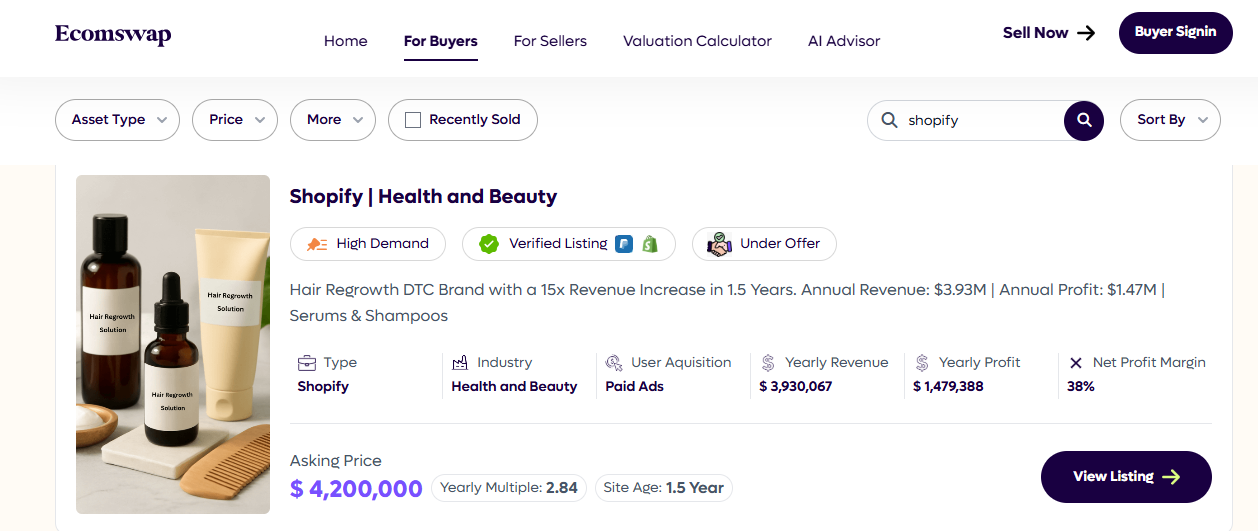

That is also where a marketplace like Ecomswap fits in. The key is to combine a clear scorecard with disciplined due diligence and a safe closing flow.

Receive an instant valuation with our Ecommerce Business Valuation Tool.

Get My ValuationStep 1 – Decide what you want and set a range

Write a one-page brief that covers niche, price range, skill match, and risk tolerance. Most profitable mid-market e-commerce stores trade on a multiple of earnings.

In 2025, many e-commerce businesses sell in the ~4.0×–6.0× range, with the exact multiple shaped by factors like customer-acquisition mix, SKU concentration, and operational complexity.

Use that band as a quick check on whether an asking price is realistic.

Our AI recommends the best listings based on your investment profile.

Discover MilesStep 2 – Build a shortlist without dead ends

Since Shopify Exchange is closed, focus on vetted listings and referrals.

Shortlist 5 to 10 stores that match your brief from places like Ecomswap and other reputable operator groups. Curated marketplaces typically pre-verify profit and traffic, publish a profit multiple, and explain their process for offers and inspections. That saves time compared with raw, unvetted listings.

Step 3 – Price the deal with 2025 comps

Take the seller’s trailing twelve months SDE or EBITDA and compare it with the 4.0x to 6.0x reference band.

- Adjust up if the store has durable organic traffic, a strong repeat rate, or diversified suppliers.

- Adjust down if revenue is concentrated in a single SKU, paid traffic dominates, or refunds are high.

Use broker comps and recent market notes to sanity-check.

Step 4 – Verify revenue, payouts, and traffic inside the accounts

Ask for read access to Shopify and analytics. In Shopify, review Finance and Payouts to reconcile order revenue with bank deposits, and export orders or reports for your date range.

In GA4, request user access at the property level to check traffic sources, conversion rates, and any sudden spikes. Tie campaigns in ads managers to actual order cohorts. This is where many weak listings fall apart.

Step 5 – Inspect operations, not just dashboards

Walk through fulfillment, returns, and customer service;

- Read supplier agreements and app dependencies

- Ask for 3 to 6 months of chargeback and refund logs and match them to payouts

- If the seller used agencies or VAs, document their scope and rates

You are buying a system that must keep working on day one.

Step 6 – Make an offer and use escrow with a clear inspection period

Submit a written offer that spells out price, what is included, your due-diligence items, an inspection period, and the escrow service you will use.

Reputable brokers and marketplaces run standardized processes, often with offer circulation rules and an inspection window once assets are migrated. If you are doing a private deal, protect both sides with a third-party escrow service such as Escrow.com, which holds funds until transfer is confirmed and supports a defined inspection period.

Step 7 – Close methodically and transfer every asset

Inside Shopify, transfer the store’s primary owner to your email from the Settings area.

- Transfer the domain to your store if it is a Shopify-managed domain, or push it at the registrar if it is external.

- Rotate API keys, staff accounts, and app permissions. Confirm payment gateways and tax settings.

- Keep a shared checklist and do not release escrow until every line item is marked complete.

Step 8 – Migrate data and keep tracking intact

Confirm GA4 access is retained under your identity, not the seller’s. Preserve UTM conventions, conversion events, and pixels so performance data is continuous.

Export product, order, and customer data snapshots for your files. This avoids gaps when you roll out changes during the first 30 days.

Step 9 – Stabilize, then optimize

For the first two weeks, hold prices and creatives steady while you watch fulfillment SLAs, ad spend, and refund rates. Only after you see stable daily gross profit should you test new offers or bundle changes.

If the store was broker-vetted, use the inspection period to validate that net profit and traffic quality match the representations.

Step 10 – Document your playbook

Write the operating playbook you wish you had on day one. Capture;

- Supplier lead times

- Reorder points

- Ad budget rules

- Customer service macros

This makes the business easier to delegate and improves resale value later, which is exactly what buyers on curated marketplaces pay for.

A simple working timeline

Week 1

Shortlist, request access, collect Shopify and GA4 read access. Reconcile payouts to orders for two recent months.

Week 2

Deep-dive diligence, supplier calls, ad account review. Price the deal against comps and submit your offer with escrow terms.

Week 3

Migrate assets, transfer ownership and domains, start inspection period. Keep ads and ops steady while you validate real-world performance.

Week 4

Release escrow after checklist completion, roll out quick wins, and lock the first 90-day plan.

How to Buy a Shopify Store in 2025 FAQs

1) How to buy a Shopify store online?

Shortlist relevant listings, check price against earnings using a sanity band around 4x to 6x SDE or EBITDA, verify revenue and traffic inside Shopify and GA4, and close through escrow. Ecomswap centralizes vetted listings and gives you a clean offer to inspection to transfer flow.

2) Can you buy an existing Shopify store?

Yes. You buy the business and assets, then the seller transfers the store’s primary owner inside Shopify. Make sure you also receive domains, brand files, and app access.

3) How much does it cost to buy a Shopify store?

Price usually equals earnings times a multiple, plus inventory and transition costs. Smaller owner run stores are often in the low to mid single digit multiples. On Ecomswap, you can compare asking prices to earnings to sanity check quickly.

4) Is buying a Shopify store legit?

It is if you do proper diligence and use escrow. Review Shopify Finance and Payouts, GA4 traffic quality, refunds and chargebacks, and supplier terms. Ecomswap encourages read only access during diligence and supports an escrowed inspection period.

5) Can I buy a premade Shopify store?

Yes. Premade or starter stores are cheaper but usually have little revenue history. If you want cash flow from day one, focus on operating stores with verifiable sales. Filter for that on Ecomswap.

6) Where do I find Shopify stores for sale?

Curated marketplaces and operator communities. Ecomswap is built for Shopify buyers so you can browse, request data, compare multiples, and make offers in one place.