If you are searching things like “how much is my YouTube channel worth”, “YouTube channel worth calculator” or “how much can I sell my YouTube channel for”, it is rarely just curiosity.

Usually there is a bigger question sitting behind it. You might be wondering whether this channel could realistically replace your job in a year or two, whether you could sell it and move on to a new project, or whether the effort you are putting in is actually creating an asset or just another demanding hobby.

This article is written with that person in mind. Imagine your YouTube Studio is open in one tab, a marketplace like Ecomswap, and you want a way to answer a simple question – “what is the value of my YouTube channel today, in a number I can explain to someone else without sounding like I pulled it out of thin air.”

We will walk through it step by step.

Step 1 – Turn Your Channel Into a Real Business Number

The starting point is not subscribers, views or plaques. Those are useful signals, but nobody buys a channel only for the sub count. Buyers care about the cash that drops out the bottom.

So the first step is to convert your channel into one clear number – average monthly net profit.

Open YouTube Studio (and any other tools you use) and pull your numbers for the last 6 to 12 months.

You want two things:

- Total income from the channel – That includes AdSense / YouTube Partner Program revenue, sponsorships, affiliate commissions, memberships, Super Thanks, and any digital products or services that clearly sell because people watch your channel.

- Costs required to keep the channel going – Editors, thumbnail designers, scriptwriters, research help, paid tools used only for the channel, and ad spend you use to push videos all belong here.

For each month, do income minus these costs. That gives you net profit for that month. Then, average it across at least 6 months, ideally 12. This is how serious buyers and YouTube brokerages talk about value: average monthly net profit, not peak month screenshots.

Once you have that one clean number, your channel is no longer “big” or “small.” It earns, say, 500 dollars or 2,000 dollars per month in profit. That is a real starting point.

If you ever use phrases like “YouTube channel value estimator” or “YouTube channel price calculator”, this monthly profit figure is usually the first thing they are really asking you for.

Get the best price for your business — we take care of the rest.

Start Selling for FreeStep 2 – Use Your Profit to Estimate Your Channel’s Value

Once you have average monthly profit, the next step is surprisingly simple. Most digital business and YouTube deals use a version of the same formula;

Channel value = adjusted annual net profit × earnings multiple

Adjusted annual net profit is just your average monthly profit multiplied by 12, with any one-off stuff removed. The multiple is how many months of profit a buyer is willing to pay to own your channel.

Specialist firms that focus on YouTube deals and online businesses commonly use a band of about 12 to 36 times average monthly net profit, depending on risk, niche, and growth.

So if your channel makes 1,000 dollars per month in steady profit:

- At 12× monthly profit, you are around 12,000 dollars

- At 24×, you are around 24,000 dollars

- At 36×, you are around 36,000 dollars

Most “YouTube channel valuation calculators” on the internet are doing exactly this: they ask you for monthly profit, then silently multiply it by something in this range.

Even a conservative range already gives you something like “realistically somewhere between low five figures and mid five figures”, depending on risk and quality. That is the basic frame you need before talking to any buyer.

Receive an instant valuation with our Ecommerce Business Valuation Tool.

Get My ValuationStep 3 – Check Your Niche, RPM and Where Your Audience Lives

At this point, many creators have a rough figure and then ask, “OK, but why is my friend’s channel valued higher even though we have similar views?” The answer usually lives in three places;

- Niche

- RPM and

- Audience Location

Different topics attract very different advertising budgets.

A channel about personal finance, software tutorials or B2B tools often earns far more per thousand views than a general meme or reaction channel, even if the view counts look similar. That feeds into RPM, which is what really matters – how much you actually earn per thousand views, across all monetization methods.

A buyer will look at your RPM and compare it in their head to typical RPMs in your niche and the countries your viewers come from. A channel where a large percentage of the audience is in high ad-spend countries and where advertisers are actively trying to reach those viewers looks much more attractive.

Example – Many CPM breakdowns by country show that places like the United States, Norway, Germany and the UK pay far more per 1,000 views than lower-income regions.

You can sanity check this yourself by playing with public “YouTube channel calculator” or “YouTube channel revenue estimator” tools. They take your views and engagement and tell you what a typical range of earnings might look like.

If your real channel is far above that for a stable period, you have a good argument that your monetization is strong and that the multiple should be on the higher side. If you are far below, a buyer will assume there is work to be done and price that into their offer.

So, when you ask what the value of your YouTube channel is, you are not only talking about how much it earns now. You are also asking how convincing your monetization story is for someone who does not know you and only sees a dashboard.

Our AI recommends the best listings based on your investment profile.

Discover MilesStep 4 – Be Honest About Risk and How Much Everything Depends On You

The next piece is harder emotionally but important ~ risk.

Think about your channel from a stranger’s perspective who has never met you, but might want to buy it, and ask yourself these questions;

- If you disappeared from camera and replaced yourself with a new host or a voiceover, would people still watch?

- Do your views come from a wide library of evergreen content, or from one or two huge videos that might never repeat?

- Is any of your content in a grey area with copyright, community guidelines or reused clips?

- Do you have some kind of system for scripting, editing, thumbnails and uploads, or is everything in your head?

Buyers and brokers who specialize in YouTube deals like Ecomswap consistently say that stable earnings, clean monetization, multiple income streams and documented processes all push valuations up.

If you can show;

- Steady earnings over a good chunk of time

- A healthy catalogue of videos that keep pulling in watch time

- Clean monetization without recent policy issues and some kind of documented workflow for thumbnails, titles, production and sponsor handling

You are no longer just selling a channel. You are selling a system. Systems tend to command better multiples because they are easier to hand over.

Part of the answer to “what is the value of my YouTube channel” is really how easy it is for someone else to run it without breaking it.

Step 5 – Use Online Tools to Cross-Verify Your Valuation For a Perspective

Once you have worked through the above steps with your own numbers, you will probably already have a rough valuation band you can live with. Only then is it worth looking outward.

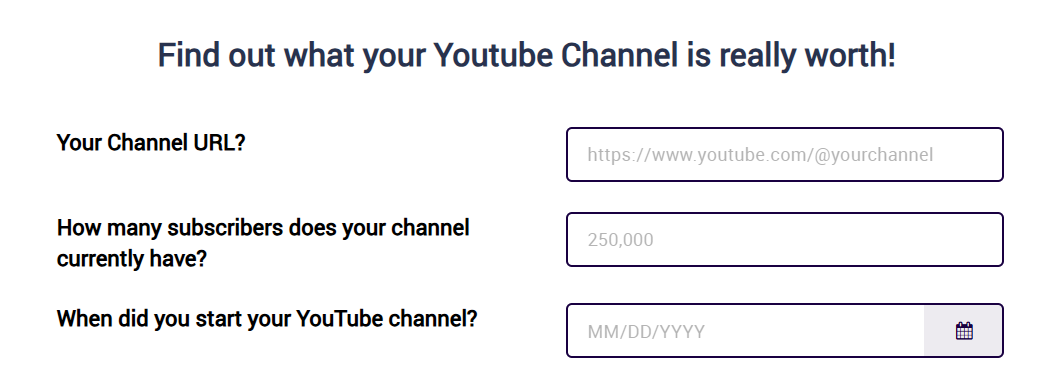

This is the moment to try the Ecomswap YouTube channel value calculator, plug in your profit and see what range they give you, not as a verdict but as a comparison. It is also the right time to quietly look at live listings of “YouTube channel for sale”, “100k YouTube channel for sale” and similar phrases on real marketplaces. Filter for channels that feel similar to yours in niche, size and monetization style, then see what asking prices they show.

You might not be ready to list yet, but this gives you a sense of what the real market seems to consider reasonable.

If you get serious about selling, you can then speak to a brokerage like Ecomswap that handles digital assets. They will take the same raw ingredients you just worked through, add their own data from recent deals, and help you refine that valuation into something that anchors a real listing or negotiation.